Mortgage Market News | 10.21.16

/Both central bankers and economic data influenced mortgage rates over the past week. Comments from the top two Fed officials caused some volatility but had little net impact. Weaker than expected inflation data was favorable. As a result, mortgage rates ended the week a little lower.

Late Friday afternoon, Fed Chair Yellen unexpectedly discussed a potential new twist on U.S. monetary policy that was being researched by the Fed. According to Yellen, the idea being explored would involve keeping monetary policy looser for longer to help boost the economy, even at the risk of higher than desired inflation levels. Concerns about a possible future Fed policy which tolerates higher inflation caused mortgage rates to increase late Friday. On Monday, however, Fed Vice Chair Fischer discussed the risks to the economy and to financial markets of keeping rates low for too long. The contrasting views of Fischer compared to Yellen soothed investors and Friday's unfavorable reaction was reversed.

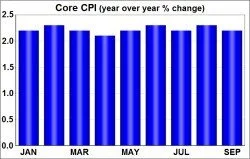

Mortgage rates improved on Tuesday following the release of the consumer price index (CPI). This widely followed monthly inflation indicator revealed that core inflation in September was lower than expected at an annual rate of 2.2%. Core CPI has held steady near current levels all year. Core inflation excludes the volatile food and energy components.

Thursday's highly anticipated European Central Bank (ECB) meeting caused little reaction for mortgage rates. The ECB made no policy changes. In the press conference, ECB President Draghi essentially postponed any new guidance on monetary policy. He said that the ECB will decide at its next meeting on December 8 whether to extend the bond purchase program which is currently set to conclude in March. Given that there is also a key U.S. Fed meeting on December 14, the first half of December will be a highly important period for mortgage rates.

Looking ahead, New Home Sales will be released on Wednesday. Durable Orders, an important indicator of economic activity, and Pending Home Sales will come out on Thursday. The first reading for third quarter GDP, the broadest measure of economic activity, will be released on Friday.